Tata AIA Sampoorna Raksha Promise: We all think about the future — not just our goals, but the what-ifs. What if something happens to me? What happens to my family, my children’s education, the home loan, or even just daily expenses?

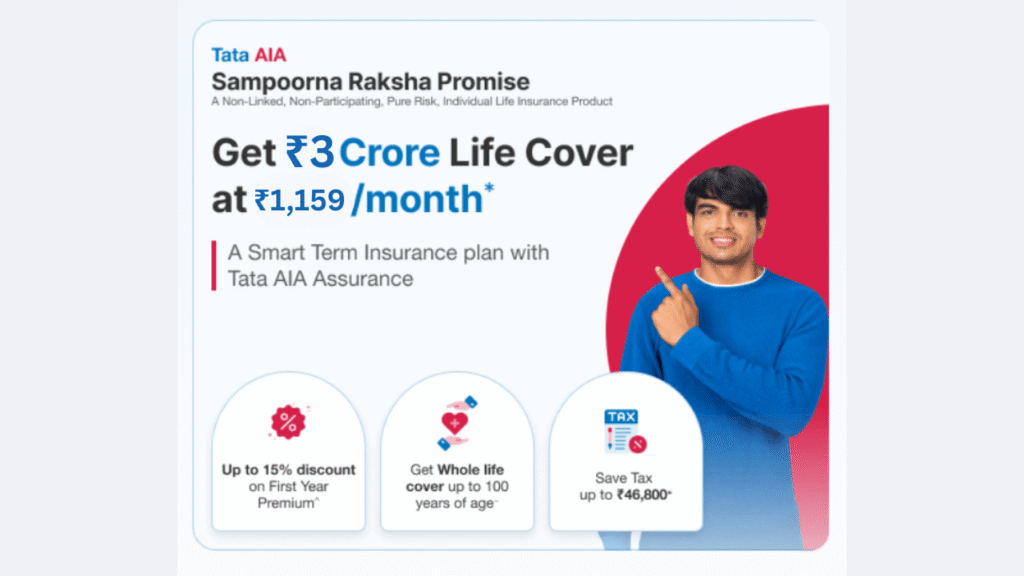

This is where a strong term insurance plan steps in. And if you’re looking for one that balances high life cover, low premium, and solid credibility, the TATA AIA Sampoorna Raksha Promise ₹3 Crore Term Plan at just ₹1159/month is worth a close look.

Let’s explore what makes this plan a smart financial move — especially if you’re in your 20s, 30s or early 40s and thinking long-term.

Understanding the Basics First: What Is a Term Insurance Plan?

Simple Definition

A term plan is pure life insurance. You pay a fixed premium for a specific period (term), and in case of your unfortunate demise during that period, your family gets a lump sum payout — the sum assured.

There’s no maturity benefit in basic term plans unless you choose a “return of premium” option.

What Is the TATA AIA Sampoorna Raksha Promise Term Plan?

TATA AIA’s Sampoorna Raksha Promise is more than just a plain vanilla term insurance. It comes with:

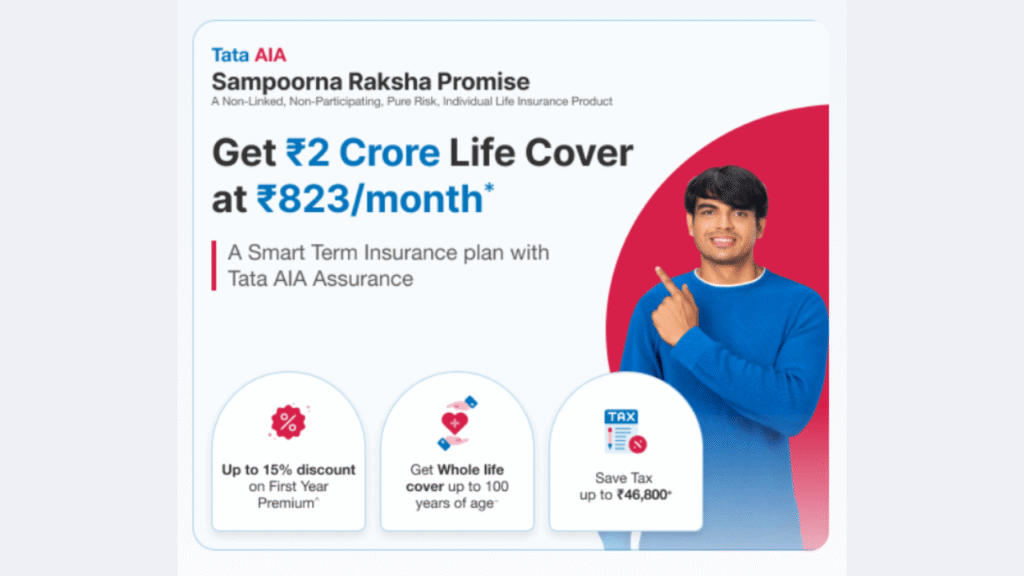

- High coverage options (₹50 Lakhs to ₹5 Crores)

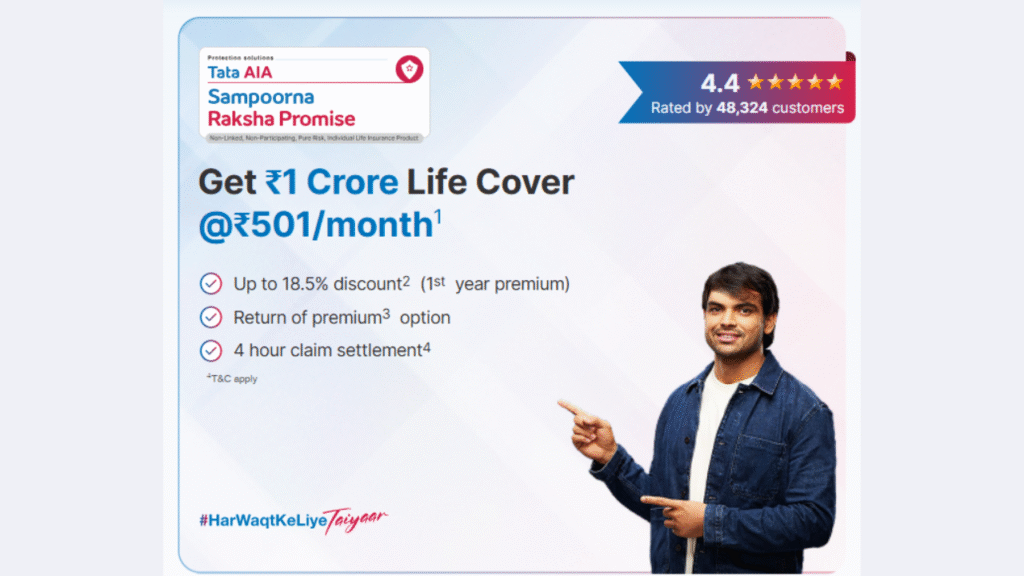

- Affordable premium starting from ₹501/month

- Multiple payout options (lump sum, monthly income, or combo)

- Life stage customization (marriage, children, loan)

- Critical illness riders and return of premium option

In this article, we are focusing on the ₹3 Crore life cover at ₹1159/month – a sweet spot for many young professionals and families.

Who Should Consider the ₹3 Crore Term Plan?

Let’s break it down with real-life scenarios:

Case 1: Rahul, Age 30, IT Professional

- Monthly Income: ₹75,000

- Family: Wife + 1 child

- Liabilities: ₹20L Home Loan

- Goal: Ensure ₹3 Cr for child’s education + spouse’s financial independence

TATA AIA’s ₹3 Cr term plan @ ₹1159/month is a no-brainer for Rahul. It ensures that even if he’s not around, his family can continue life with dignity.

Case 2: Dr. Sneha, Age 35, Pediatrician

- Monthly Income: ₹1.2L

- Single Mother of Twin Daughters

- Dream: Secure ₹1 Cr each for daughters’ education and ₹1 Cr for retirement corpus

With ₹1159/month, Dr. Sneha buys peace of mind and future-proofing — without compromising today’s budget.

What’s So Special About ₹1159/Month Premium?

Let’s be honest — ₹1159 is what many spend on weekend takeouts, OTT subscriptions, or Uber rides. But here, you’re buying ₹3 Crores worth of protection.

Cost vs Benefit Comparison

| Monthly Cost | What It Buys You |

|---|---|

| ₹1159 | ₹3 Cr Life Cover from TATA AIA |

| ₹1200 (on average) | 3 Zomato Swiggy Orders |

| ₹1000-1200 | Netflix + Spotify + Amazon Prime combined |

| ₹1100 | EMI for an entry-level smartphone |

What gives real ROI? The ₹3 Cr life cover wins hands down.

Key Features of TATA AIA Sampoorna Raksha Promise Term Plan

🔹 1. Flexible Coverage Upto 100 Years (Whole Life Option)

You can choose to cover yourself up to 85 or even 100 years — ideal if you want lifelong protection.

🔹 2. Return of Premium (ROP) Option

Don’t want to “lose” your money if you survive the term? Choose ROP. Your premiums are returned on survival.

🔹 3. Multiple Payout Options

You can choose:

- Lump sum

- Monthly income

- Increasing income

- Combo of above

This flexibility helps your family handle both immediate and ongoing expenses.

🔹 4. Critical Illness and Accidental Death Riders

For added premium, get covered against 62 critical illnesses or accidental total permanent disability.

🔹 5. Life Stage Benefit

Get additional cover without medicals at life milestones like marriage or childbirth.

Sample Premiums for ₹3 Crore Cover

| Age | Policy Term | Annual Premium (₹) | Monthly (₹) |

|---|---|---|---|

| 25 | 30 years | ₹13,200 | ₹1,159 |

| 30 | 30 years | ₹15,000 | ₹1,300 |

| 35 | 25 years | ₹17,500 | ₹1,500 |

Premiums vary slightly based on gender, smoker status, and payment frequency.

Is ₹3 Cr Coverage Enough?

A Simple Formula:

Ideal Cover = 15 to 20 X Annual Income + Liabilities

So if your annual income is ₹12 Lakhs:

- 15x = ₹1.8 Cr

- Add Home Loan = ₹30L

- Add Children’s Education = ₹40L

- Ideal Cover = ₹2.5 to ₹3 Cr

That’s why ₹3 Cr is emerging as the sweet spot for India’s growing middle-class professionals.

What Makes TATA AIA a Trusted Brand?

TATA’s Legacy + AIA’s Asian Insurance Expertise

- Claim Settlement Ratio (FY 2022-23): 99.01%

- Solvency Ratio: 1.91 (IRDAI requirement: 1.5)

- Incurred Claims Ratio: Healthy and consistent

- Trusted by 7 million+ policyholders

You’re not just buying a plan. You’re buying from a brand built on trust and reliability.

How to Buy TATA AIA Sampoorna Raksha Promise Plan Online?

Step-by-Step Process:

- Visit official TATA AIA Life Insurance website

- Choose Sampoorna Raksha Promise plan

- Enter your age, income, sum assured (₹3 Cr)

- Customize term & add riders if needed

- Fill in details & complete medicals (if required)

- Pay online and download policy document

Tip: Always compare with Policybazaar or other insurance marketplaces for offers or cashback.

Pros and Cons (Honest Review)

👍 Pros:

- High coverage at low premium

- Excellent claim settlement ratio

- Multiple payout and rider options

- Customization at every life stage

- Backed by trusted TATA brand

👎 Cons:

- Premium rises significantly after 40

- No investment return (unless you choose ROP)

- Medical tests may be needed for ₹3 Cr+

Expert Opinion: Why Financial Advisors Recommend It

“For urban professionals earning ₹8–15 LPA, a ₹3 Cr cover is non-negotiable. Plans like Sampoorna Raksha Promise give you that cover at less than your coffee budget. It’s a financial firewall for your family.”

— Manoj Kumar, SEBI Registered Financial Planner

Mistakes to Avoid While Buying This Plan

- ❌ Choosing too short a term (choose till age 65–70)

- ❌ Ignoring critical illness riders

- ❌ Hiding medical conditions (can affect claim)

- ❌ Skipping regular reviews (update cover as you grow)

The Emotional ROI of Term Insurance

It’s not just about money. It’s about peace of mind, about knowing your family won’t suffer financially if life throws a curveball.

Even if you never use this plan — and we all hope that’s the case — the emotional ROI is unmatched.

Final Verdict: Is It Worth It?

If you’re earning, have dependents, and don’t want to leave their future to chance, then…

YES – ₹3 Crore cover at ₹1159/month from TATA AIA is worth every rupee.

It’s low-cost, high-impact insurance from a brand you can trust. The earlier you start, the better the rates and longer the protection.

TATA AIA Sampoorna Raksha Promise ₹3 Crore Term Plan @ ₹1159/month offers affordable life cover with multiple payout options, critical illness riders, and coverage till 100 years. Ideal for professionals aged 25–40. Backed by a 99% claim settlement ratio, it’s a reliable and smart choice for long-term family protection.