Axis Max Life Term Insurance: Life is unpredictable. One moment you’re planning your child’s education, and the next, you’re faced with the uncertainty of what could happen if you’re no longer around. It’s uncomfortable to think about, but essential to plan for.

That’s where Axis Max Life Term Insurance comes into the picture. Designed to offer financial protection in the face of life’s uncertainties, this policy ensures your loved ones won’t face financial distress if the unexpected happens.

But is it the right term plan for you? Let’s break it down, step by step, in a natural, no-jargon way that actually helps you decide.

What Is Axis Max Life Term Insurance?

Axis Max Life Term Insurance is a protection-focused life insurance plan offered through a strategic partnership between Axis Bank and Max Life Insurance. The idea is simple: you pay a small premium, and in return, your family gets a large sum assured if something happens to you.

Unlike traditional life insurance policies that mix investment and protection, a term plan is pure protection—which makes it far more affordable.

Key Benefits at a Glance:

- High coverage at low premiums

- Option to add critical illness and disability riders

- Flexible policy terms (up to 85 years of age)

- Tax benefits under Section 80C and 10(10D)

- Option for return of premium

Real-Life Scenario: Why Rohit Chose Axis Max Life Term Plan

Let’s meet Rohit, a 35-year-old IT professional in Pune.

He earns ₹15 lakh per annum and recently welcomed a baby girl. After a casual chat with a friend who lost his brother unexpectedly, Rohit realized his family could be in serious trouble without a backup plan.

He researched multiple term plans but was drawn to Axis Max Life Term Insurance. The reason?

“It gave me ₹1 crore coverage for just around ₹800 per month. I also liked that I could include critical illness and disability benefits, which gave me peace of mind.”

That’s the thing—term insurance isn’t just about death. It’s about living with dignity even when things go wrong.

How Does Axis Max Life Term Insurance Work?

Step 1: Choose the Sum Assured

Decide how much coverage your family would need in your absence. A good thumb rule is 10–15 times your annual income.

Step 2: Pick the Policy Term

You can choose coverage until the age of 60, 65, or even 85. Longer terms usually mean slightly higher premiums, but better peace of mind.

Step 3: Customize With Riders

Axis Max Life Term Plan allows you to add useful riders like:

- Critical Illness Rider: Get paid if diagnosed with a major illness like cancer or heart disease.

- Accidental Death Benefit: Additional payout in case of accidental death.

- Disability Rider: Covers loss of income due to disability.

Step 4: Pay Premiums Regularly

You can pay monthly, quarterly, or annually. Premiums are fixed, so they won’t increase as you age.

Step 5: Make a Claim (If Required)

If something happens, your nominee just needs to file a claim online or offline. Axis and Max Life have a strong track record, with a claim settlement ratio of 99.51% (as per IRDAI Annual Report 2022–23). That’s peace of mind, guaranteed.

Axis Max Life Term Plan Variants You Should Know About

Here’s a quick look at the different term plan variants:

1. Smart Secure Plus Plan

- Provides life cover with critical illness and disability options

- Allows premium back after policy ends (Return of Premium)

- Joint life cover available for spouse

2. Online Term Plan Plus

- Pure protection term plan

- Cheaper if bought online

- Customizable riders

3. Smart Term Plan

- Option to increase life cover as responsibilities grow

- Offers cover till 85 years of age

Each variant is designed to match different life stages and priorities.

Why Choose Axis Max Life Term Insurance Over Others?

There are plenty of term plans out there, so what makes this one special?

1. Strong Brand Assurance

- Axis Bank’s reach + Max Life’s insurance legacy = trust

- Over ₹1 trillion assets under management

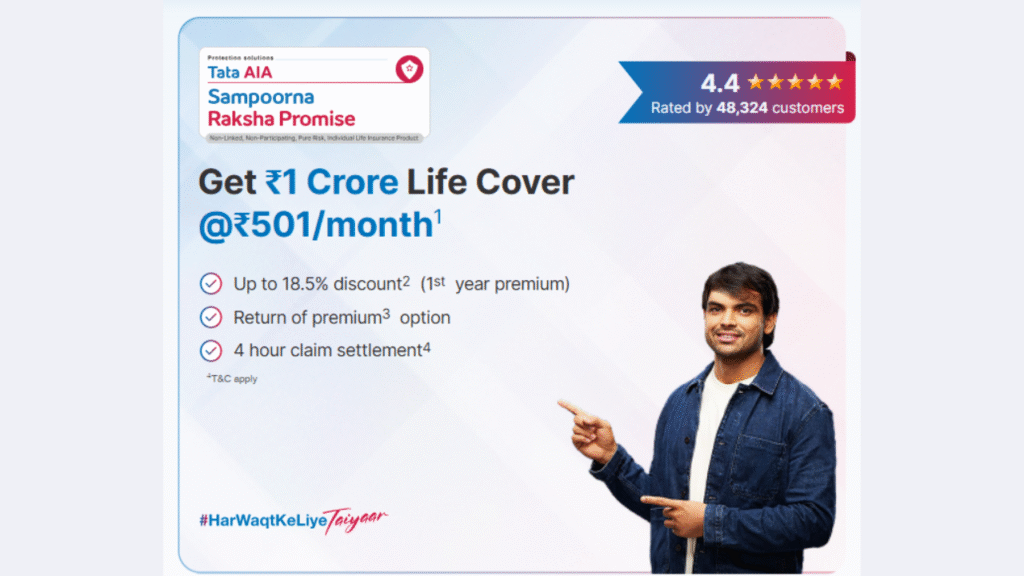

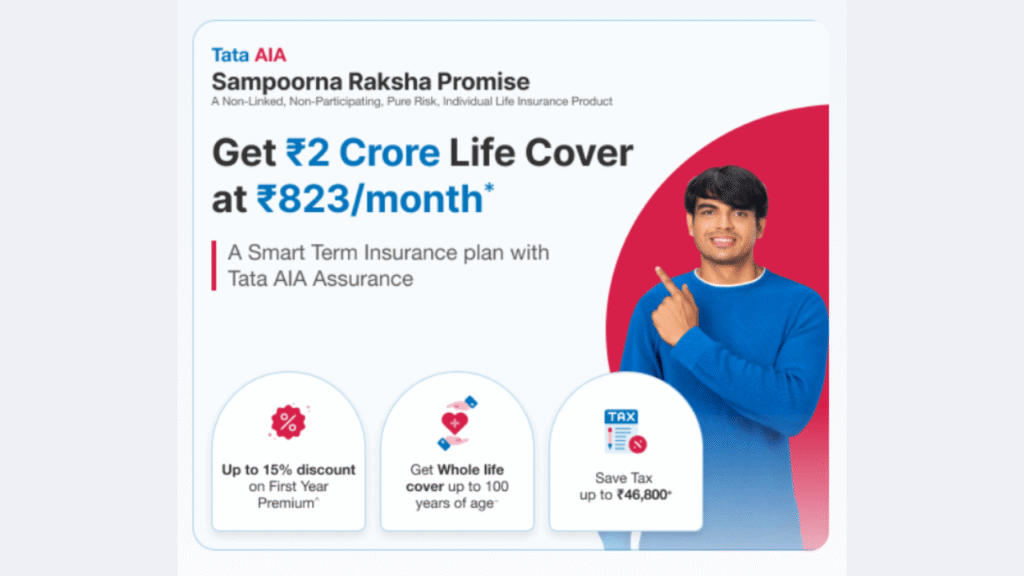

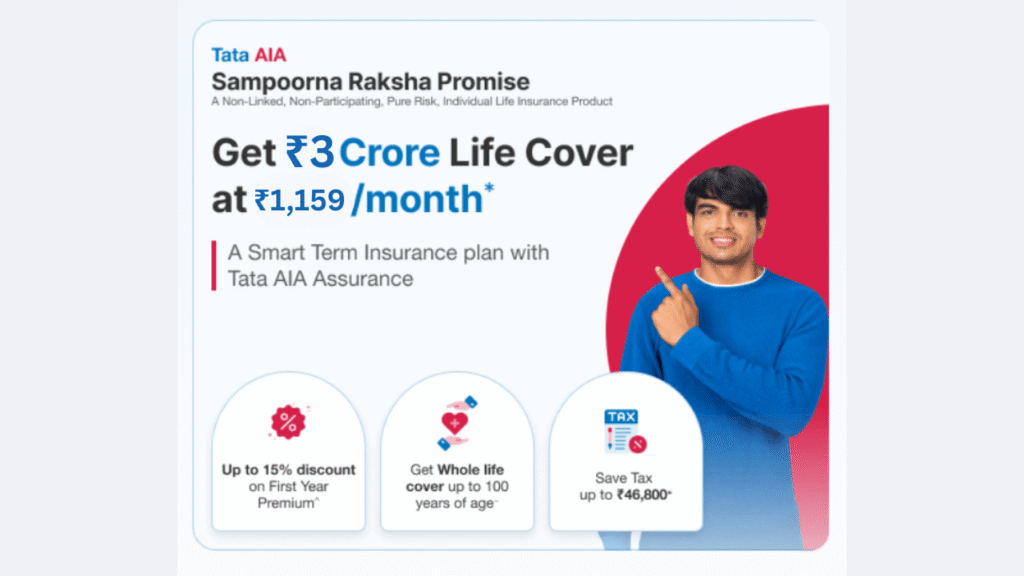

2. Affordable Premiums

- Starting as low as ₹500/month for ₹1 crore cover

- Return of premium plans available too

3. High Claim Settlement Ratio

- At 99.51%, this is among the highest in the industry

4. Flexible Payment and Coverage Options

- Covers until age 85

- Increasing cover options

- Premium payment flexibility

Let’s Talk Numbers: Sample Premiums

| Age | Sum Assured | Policy Term | Monthly Premium* |

|---|---|---|---|

| 30 | ₹1 Crore | 30 Years | ₹524 |

| 35 | ₹1 Crore | 30 Years | ₹738 |

| 40 | ₹1 Crore | 20 Years | ₹1,120 |

*Premiums are approximate and can vary based on health, lifestyle, and riders.

How to Buy Axis Max Life Term Plan?

✅ Step-by-Step Process:

- Visit the official Axis Bank or Max Life website.

- Fill in your basic details like age, income, smoking habits.

- Choose your preferred sum assured and policy term.

- Add Riders as needed.

- Pay the Premium online.

- Medical Test (usually at no cost to you).

- Policy Issued after underwriting.

You can also apply via Axis Bank branches or through certified advisors.

Real User Reviews

Here are what real users are saying online:

Shalini Desai, 32, Mumbai: “Axis Max Life gave me the best balance of cost and features. I liked that I could get a return of premium if I survive.”

Vikram Singh, 41, Delhi: “Their online platform was easy to use, and customer care actually answered my questions patiently. Felt trustworthy.”

These are not just random testimonials. They’re reflective of a growing trust in this product.

Expert Opinion: What Financial Planners Say

We spoke with Rakesh Sethi, a certified financial planner:

“A term plan is the foundation of any financial portfolio. With Axis Max Life, you’re getting a product backed by strong institutions. Always buy early, include critical illness riders, and make sure your nominee knows how to claim.”

His advice? Don’t wait until it’s too late.

Tax Benefits You Can Claim

Another major perk is the tax savings.

Under Section 80C:

You can claim a deduction of up to ₹1.5 lakh on premiums paid.

Under Section 10(10D):

The death benefit is completely tax-free for your nominee.

Riders like health cover can also offer additional tax savings under Section 80D.

Common Myths About Term Insurance—Busted

❌ “It’s a waste if I survive”

✅ Reality: Think of it as a fire extinguisher—you hope you never need it, but you’re glad it’s there.

❌ “Only breadwinners need term insurance”

✅ Reality: Homemakers and spouses contribute too. You can take joint life cover.

❌ “I’ll buy it later”

✅ Reality: Premiums go up with age. Buy early and lock in low rates.

Who Should Buy Axis Max Life Term Insurance?

This plan suits:

- Salaried individuals (age 25–55)

- Young parents with kids

- Entrepreneurs who don’t have employer-provided cover

- Anyone with loans, dependents, or future responsibilities

If you earn, save, or dream for your family—this is for you.

Final Thoughts: Is Axis Max Life Term Plan Worth It?

Absolutely. With affordable premiums, high coverage, strong claim settlement history, and options to customize your plan, it ticks all the right boxes.

More importantly, it brings peace of mind.

So instead of worrying about “what if,” be the person who planned ahead. Be the reason your family smiles, even in your absence.

FAQs

Is Axis Max Life Term Plan available online?

Yes, you can purchase it directly from the Axis Bank or Max Life Insurance websites.

Can I get a ₹1 crore cover at a low premium?

Yes, if you’re young and healthy, you can get ₹1 crore cover for under ₹800/month.

What is the claim settlement ratio of Axis Max Life?

As per IRDAI 2022–23, the claim settlement ratio is 99.51%.

Can I add riders to my plan?

Yes. Riders like critical illness, accidental death, and disability can be added.