Tata AIA Sampoorna Raksha Promise: Imagine this—your family is living peacefully, your children’s education is on track, and your home loan is almost paid off. Then, life throws a curveball. What happens to your family’s financial stability if you’re suddenly not around? It’s a question none of us want to ask but should.

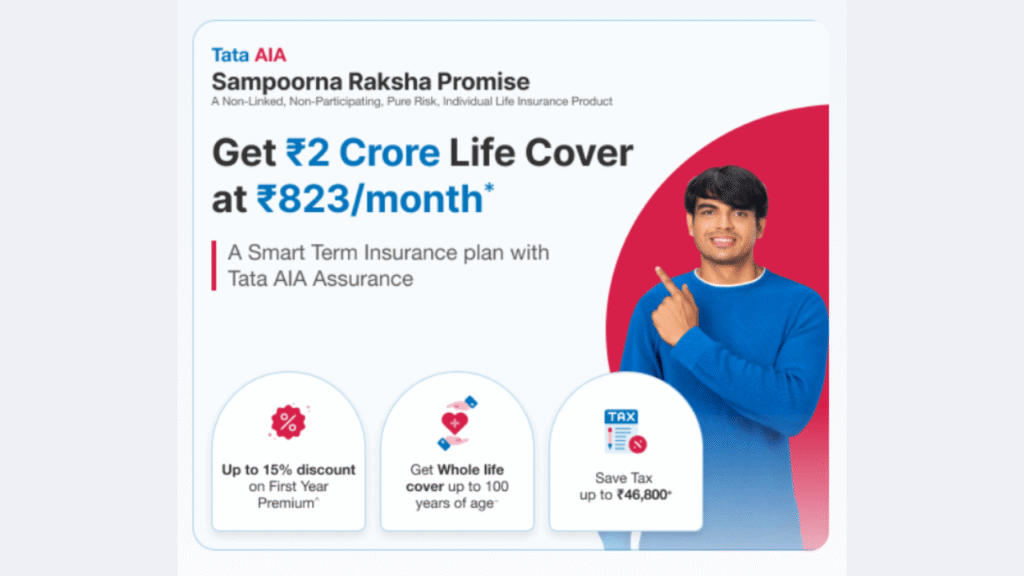

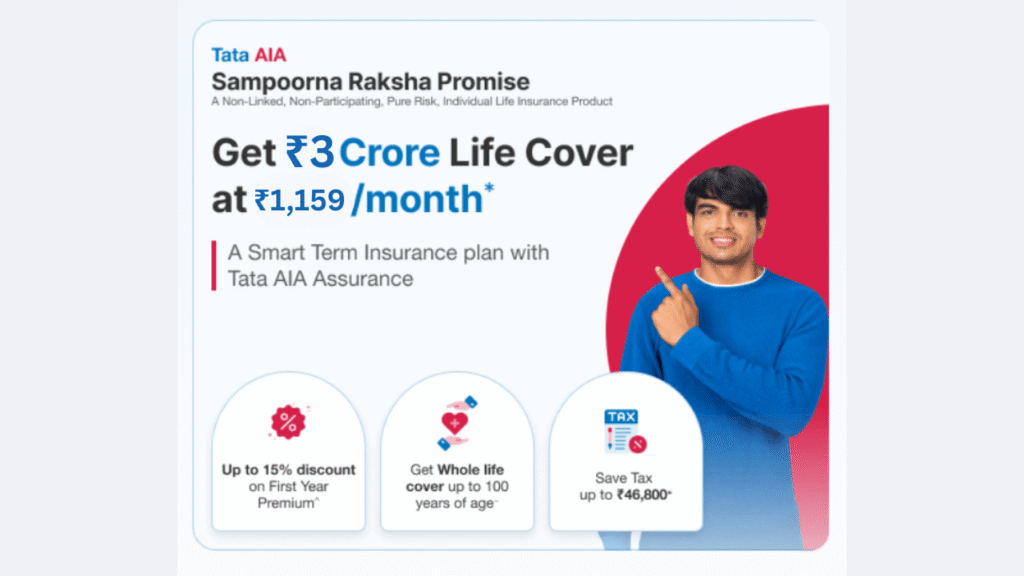

This is where term insurance becomes a real lifesaver—literally and financially. And one plan that has caught the eye of many smart, security-conscious Indians is the TATA AIA Sampoorna Raksha Promise Term Plan, offering a life cover of ₹1 crore for a premium as low as ₹501/month*.

Let’s dive into the fine print, break it down with real-life examples, and see whether this plan truly lives up to the promise—or if it’s just another number on paper.

What Is the TATA AIA Sampoorna Raksha Promise @₹501/month Term Plan?

The Sampoorna Raksha Promise is a pure term insurance plan from TATA AIA Life Insurance. That means it’s designed purely for life protection—no savings, no investments, just pure financial cover for your loved ones in your absence.

What makes it special?

- Life cover up to ₹1 crore

- Premiums starting from ₹501/month*

- Multiple payout options for the nominee

- Flexibility in choosing the policy term

- Riders to enhance coverage (like critical illness, accidental death, waiver of premium)

In short, it’s a solid safety net tailored to modern Indian families.

Why Term Insurance Is a Must-Have in Today’s World

Let’s address the elephant in the room—why term insurance?

Term insurance is the most affordable way to protect your family’s financial future. You pay a small premium, and in return, your loved ones get a substantial sum assured (like ₹1 Cr) in case of your untimely death.

Real-Life Scenario

Take the example of Ravi, a 32-year-old IT professional from Pune. He recently bought the TATA AIA ₹1 crore plan at ₹501/month. Tragically, a year later, a road accident claimed his life. Thanks to the policy, his wife received ₹1 crore tax-free, which helped her:

- Pay off the home loan

- Fund their daughter’s education

- Maintain the same lifestyle

- Stay financially independent

This is what a term plan does—it replaces your income when your family needs it the most.

What You Get: Features & Benefits Breakdown

Let’s break down the key features of this plan in simple terms:

✅ High Life Cover at Affordable Cost

- Life cover: ₹1 Cr

- Starting premium: ₹501/month* (subject to age, health, term, riders)

- Age eligibility: 18 to 65 years

✅ Flexible Policy Terms

- Policy term options: 10–40 years

- Premium payment options: Regular, limited pay, or single pay

- Can be customized to align with your retirement or children’s education plans

✅ Multiple Payout Options

Your nominee can choose how they want to receive the claim:

- Lump sum: Full amount at once

- Monthly income: Regular payouts

- Combination: Part lump sum + part income

This flexibility ensures your family can manage both immediate and long-term expenses.

✅ Riders for Enhanced Protection

You can add extra coverage with riders like:

- Critical illness cover

- Accidental death benefit

- Waiver of premium on disability

- Terminal illness benefit

These make sure you’re covered even before death—in case of life-threatening illnesses or injuries.

TATA AIA ₹1 Cr Term Plan at ₹501/Month: What Financial Experts Say

Dr. Vivek Kulkarni, CFP®

“A term plan with a ₹1 crore cover at this price is a no-brainer, especially for young professionals. However, don’t just look at the premium—evaluate your financial goals, liabilities, and dependents’ needs.”

Research Snapshot

- According to IRDAI, term insurance penetration in India is still under 3%—but rising fast.

- A ₹1 Cr cover today will be equivalent to ₹1 Cr or less in 20 years due to inflation.

- Experts recommend at least 10–15x your annual income as term coverage.

So if your income is ₹15 lakh per annum, a ₹1 crore policy is spot on.

Eligibility & Application Details

Here’s what you’ll need to apply:

| Criteria | Details |

|---|---|

| Entry age | 18 to 65 years |

| Maturity age | Up to 100 years |

| Sum assured range | ₹50 lakh to ₹5 crore |

| Premium payment term | Single, limited, or regular |

| Medicals required? | Depends on age & sum assured |

You can apply online, offline, or through an advisor. Many applicants complete the process 100% digitally, including medicals, depending on their age and health.

Hidden Gems: Lesser-Known Features

🚼 Return of Premium Option

Want your money back if nothing happens? The “return of premium” add-on gives you all premiums back at maturity (higher cost, though).

🔒 Life Stage Option

Increase your cover when you marry, have a child, or take a home loan—without new medical tests.

🧘 Mental Wellness Benefits

Some Tata AIA plans include access to mental health counseling and wellness apps like Practo ProHealth.

⚖️ TATA AIA vs Other Term Plans

Let’s compare Tata AIA’s plan to a few popular competitors:

| Feature | Tata AIA SRP | HDFC Click2Protect | Max Life Smart Secure | LIC Tech Term |

|---|---|---|---|---|

| Max Sum Assured | ₹5 Cr | ₹3 Cr | ₹5 Cr | ₹1 Cr |

| Monthly Premium (for ₹2 Cr)* | ₹501 | ₹545 | ₹510 | ₹650 |

| Claim Settlement Ratio (2023) | 99.01% | 98.66% | 99.34% | 98.52% |

| Critical Illness Rider | ✅ | ✅ | ✅ | ❌ |

| Return of Premium Option | ✅ | ✅ | ✅ | ✅ |

(*For 30-year-old male, non-smoker, 20-year policy term)

Clearly, Tata AIA is competitive on pricing, features, and flexibility.

What Real Users Are Saying

Akash Jain, Mumbai

“The entire purchase was online. I got my policy document within 24 hours. No agent pushing unnecessary riders. Very satisfied!”

Priya Verma, Noida

“I opted for the return of premium option. It gives peace of mind that either my family or I will benefit in the end.”

How to Calculate Your Premium

You can use Tata AIA’s online premium calculator. Here’s a sample:

Profile:

- Age: 30

- Non-smoker

- Sum assured: ₹1 Cr

- Policy term: 30 years

Estimated Premium: ₹501/month*

Note: Actual premium varies based on age, health, lifestyle, and riders chosen.

Common Mistakes to Avoid

- ❌ Choosing lowest premium without checking claim record

- ❌ Not disclosing smoking habits or health conditions

- ❌ Ignoring riders that could provide extra protection

- ❌ Under-insuring (₹50L when your need is ₹2Cr)

- ❌ Forgetting to update nominee after life changes

Final Thoughts: Should You Buy This Plan?

If you’re between 25–45 years of age, healthy, and looking for:

- Maximum cover

- Minimum premium

- Trusted brand

- Customizable features

…then the TATA AIA Sampoorna Raksha Promise Term Plan is a smart move. At ₹501/month*, it offers incredible value—provided you understand what you’re buying and select the right options.

Quick FAQs

Q1. Is the ₹501/month premium guaranteed?

👉 It’s indicative—for a healthy, young non-smoker. Your premium may vary.

Q2. What happens if I miss a premium?

👉 There’s a grace period (15–30 days). Missed premiums can lapse the policy, but revival is possible.

Q3. Is claim settlement easy with Tata AIA?

👉 Yes. Their 99.01% claim settlement ratio and 4-hour express claim service ensure peace of mind.

Q4. Is term insurance tax-saving?

👉 Absolutely. Premiums qualify under Section 80C, and the death benefit is tax-free under Section 10(10D).

🔚 In Conclusion

A term plan isn’t about fear—it’s about responsibility. It’s about knowing your family’s dreams won’t die if you do.

For ₹501 a month*, you can leave behind ₹1 crore worth of dignity, security, and hope.

So ask yourself: If not now, then when?

Want to explore this plan? Visit TATA AIA’s official website or connect with a verified advisor today.