Introduction: The Reality Check We All Need

Imagine this: you’re 30, healthy, with a growing family, a new home loan, and dreams that reach beyond the stars. Life feels secure, right?

But what if the unexpected happens?

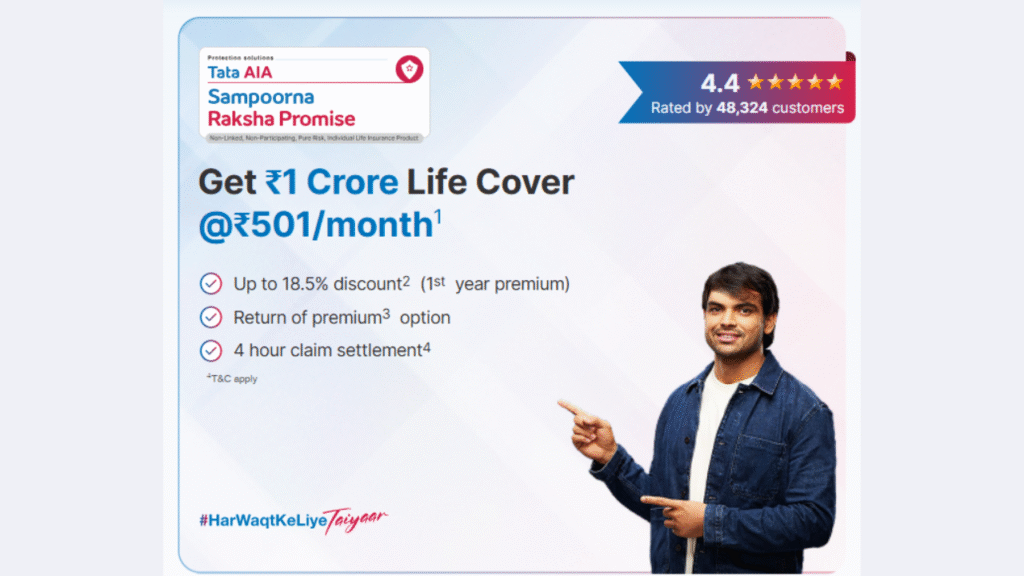

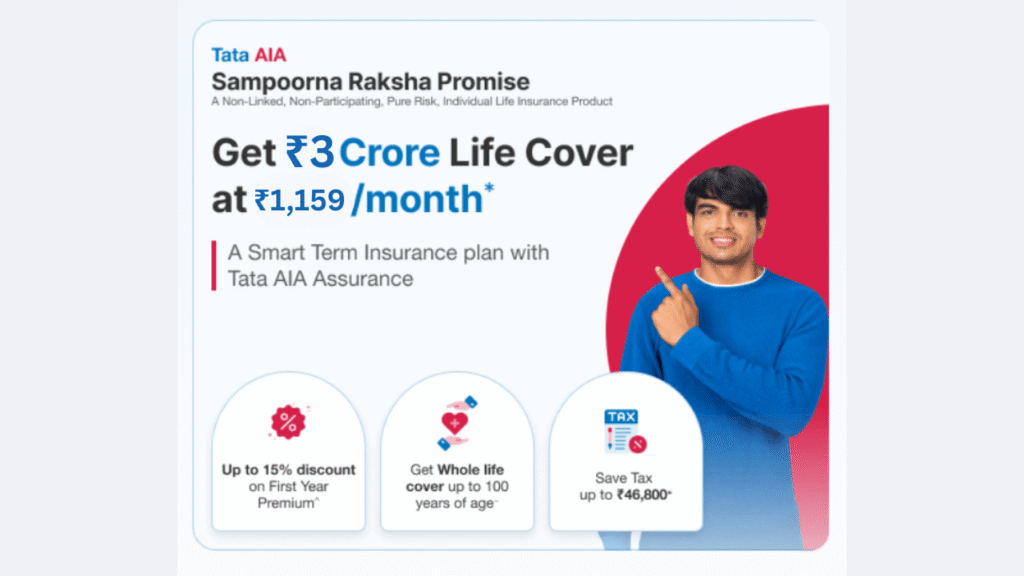

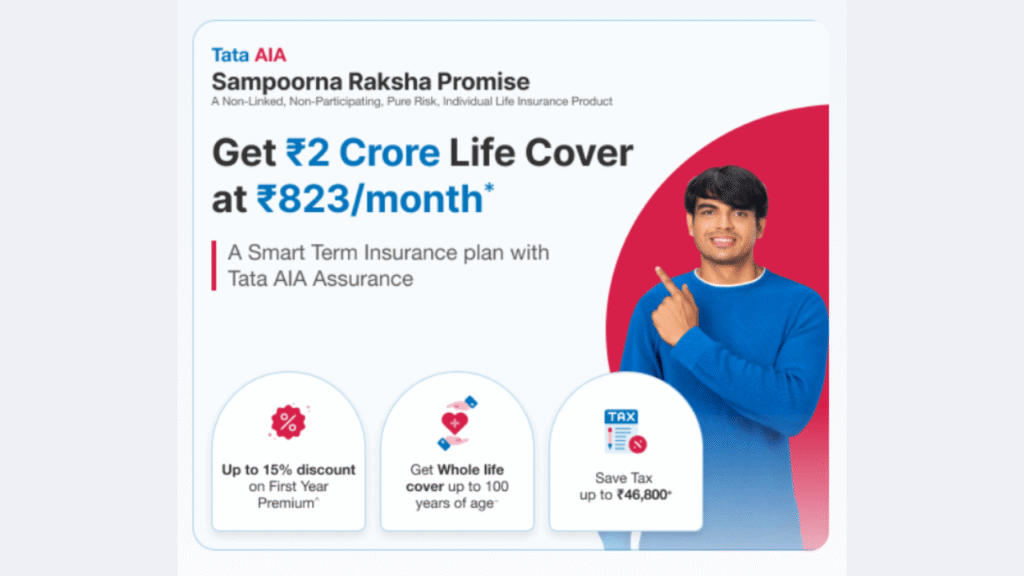

No one wants to think about it—but planning for it is essential. That’s where term insurance becomes not just a product, but a promise. And when we talk about promises, the TATA AIA Sampoorna Raksha Promise Plan stands tall.

Offering a ₹2 crore life cover for just ₹804/month, this plan is turning heads across India. But is it too good to be true? Or is it the smart financial protection your family deserves?

Let’s break it all down.

What is TATA AIA Sampoorna Raksha Promise?

A Term Plan That Goes Beyond

At its core, the TATA AIA Sampoorna Raksha Promise is a term life insurance plan—but with a modern twist. Unlike traditional term plans that offer only a death benefit, this one offers both protection and return of premium options, along with customizable features.

The idea is simple: ensure your family’s financial well-being in your absence without burning a hole in your pocket today.

Key Features at a Glance

| Feature | Details |

|---|---|

| Plan Type | Term Life Insurance |

| Coverage | Up to ₹2 Crore |

| Premium | Starts from ₹804/month (based on age, health, and term) |

| Premium Payment Options | Regular, Limited, Single Pay |

| Policy Term | 10 to 40 years |

| Entry Age | 18 to 60 years |

| Maturity Benefit | Available under Return of Premium option |

| Riders | Critical Illness, Accidental Death, Waiver of Premium |

Let’s Talk Numbers: ₹804/Month for ₹2 Crore Cover—Real or Hype?

It sounds almost unreal—a ₹2 crore cover for just ₹804/month.

But here’s the thing: that premium is achievable, under specific conditions:

- Age: Around 25–30 years

- Non-smoker

- Healthy lifestyle

- Choosing regular term (without return of premium)

As you age, smoke, or choose riders and add-ons, the premium naturally increases. But even then, the value proposition remains strong.

👉 Expert Insight: According to IRDAI’s insurance report 2023, early-term insurance buyers save up to 40% in lifetime premiums.

Why ₹2 Crore? Is It Overkill?

Not really. Let’s do the math.

Here’s how your family could need that ₹2 crore:

- ₹75 lakh: Home loan + other debts

- ₹50 lakh: Children’s higher education

- ₹25 lakh: Spouse’s retirement

- ₹50 lakh: Day-to-day living expenses for 10–15 years

This isn’t luxury. It’s basic financial security.

Real-Life Example: Meet Ravi, 32, Software Engineer from Pune

Ravi is married with a toddler and pays an EMI of ₹38,000/month. He opted for TATA AIA Sampoorna Raksha Promise with a ₹2 crore cover at ₹820/month. Here’s why:

- He wants his family to continue their lifestyle even in his absence.

- His wife doesn’t work, so the life cover will help manage the home loan and his child’s future education.

- He added a critical illness rider, just in case.

“Knowing that they won’t have to worry about money if something happens to me gives me real peace of mind,” says Ravi.

Top 7 Benefits That Set This Plan Apart

1. Affordability with Flexibility

You choose the premium payment frequency—monthly, yearly, or single-shot.

2. Return of Premium Option

Don’t like the idea of “use it or lose it”? With this option, you get back the premiums you paid if you survive the term.

3. Life Stage Benefits

You can increase your cover at key milestones—marriage, becoming a parent, or taking a home loan.

4. Rider Options

Customize your plan with critical illness, accidental death, or waiver of premium riders.

5. Maturity Benefit

Get back the money you invested (in case of return of premium) as a tax-free lump sum.

6. Tax Benefits

- Section 80C: Premiums up to ₹1.5 lakh/year are deductible.

- Section 10(10D): Death/maturity payouts are tax-free.

7. Trusted Brand

TATA AIA Life Insurance is backed by Tata Sons (India’s most trusted conglomerate) and AIA Group (Asia’s largest insurance group).

Who Should Buy This Plan?

- Young professionals in their 20s and 30s

- Newly married couples

- Home loan borrowers

- Parents with school-going kids

- First-time insurance buyers

How to Buy the Plan in 5 Easy Steps

- Visit TATA AIA Official Website or trusted platforms like PolicyBazaar.

- Use the online calculator to get your premium estimate.

- Fill in personal details – age, gender, smoking status.

- Choose riders and policy term based on needs.

- Pay and complete medicals (if applicable).

You can also buy offline through a licensed agent.

Things to Watch Out For

1. Don’t Skip the Fine Print

Always read the policy brochure before buying. Understand what’s excluded, especially in riders.

2. Medical Test is Mandatory

For higher covers like ₹2 crore, a medical check-up is usually required.

3. Premium May Vary

₹804/month is a starting price for young, healthy non-smokers. If you’re older or have health conditions, expect it to be higher.

Expert Opinions That Matter

🧠 Dr. Rajesh Desai, Financial Advisor:

“Term plans like this are no longer optional—they are a necessity. The ₹804/month deal offers immense value. But don’t forget to add riders depending on your lifestyle risks.”

💡 Sneha Malhotra, Insurance Blogger:

“What I love about TATA AIA’s plan is the transparency. The option to get your premiums back makes it easier to sell to hesitant first-timers.”

What Customers Are Saying

⭐️⭐️⭐️⭐️⭐️ “It was quick, digital, and hassle-free. Loved the premium return feature.” — Arjun, 28, Mumbai

⭐️⭐️⭐️⭐️ “My agent helped me add critical illness cover. It gave me added confidence.” — Priya, 35, Delhi

⭐️⭐️⭐️⭐️⭐️ “Affordable and comes from a brand I trust. Worth it.” — Ravi, 32, Pune

Final Verdict: Should You Buy?

Absolutely yes, if you’re looking for:

- Long-term protection

- Budget-friendly premiums

- Peace of mind for your loved ones

The ₹2 crore life cover for ₹804/month is more than just a marketing gimmick—it’s a real, value-packed option when planned right.

FAQs

❓ Can I get this plan without a medical test?

For smaller cover amounts, yes. But for ₹2 crore, a medical test is almost always mandatory.

❓ Is the premium fixed for the entire term?

Yes. Once set, your premium remains fixed throughout the policy term.

❓ Can I increase my sum assured later?

Yes, under the life stage benefit feature.

❓ What if I stop paying premiums?

Your policy will lapse. Some benefits can be revived within a grace period, so always keep your premiums up to date.

❓ Is this better than LIC term plans?

LIC offers solid plans but often at higher premiums. TATA AIA scores on affordability, flexibility, and rider options.

In Conclusion

A term plan is not about dying—it’s about living responsibly. The TATA AIA Sampoorna Raksha Promise ₹2 Cr plan at ₹804/month is one of the best tools to secure your family’s future while keeping your present stress-free.

Take the first step today. Because planning for tomorrow starts now.

Let me know if you’d like this as a downloadable document or want the same article in Hindi as well.